Experian IdentityWorks Identity Theft Protection

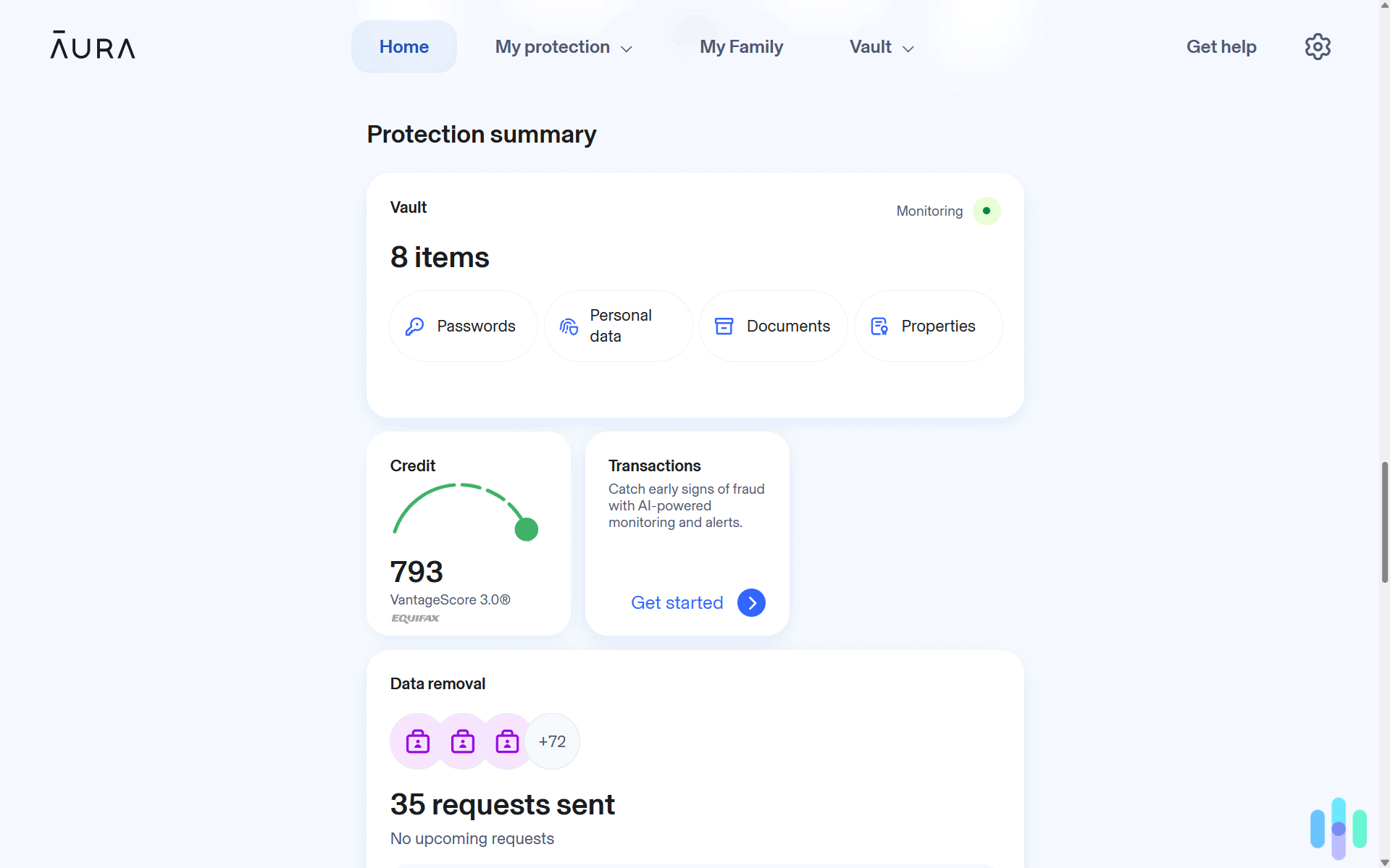

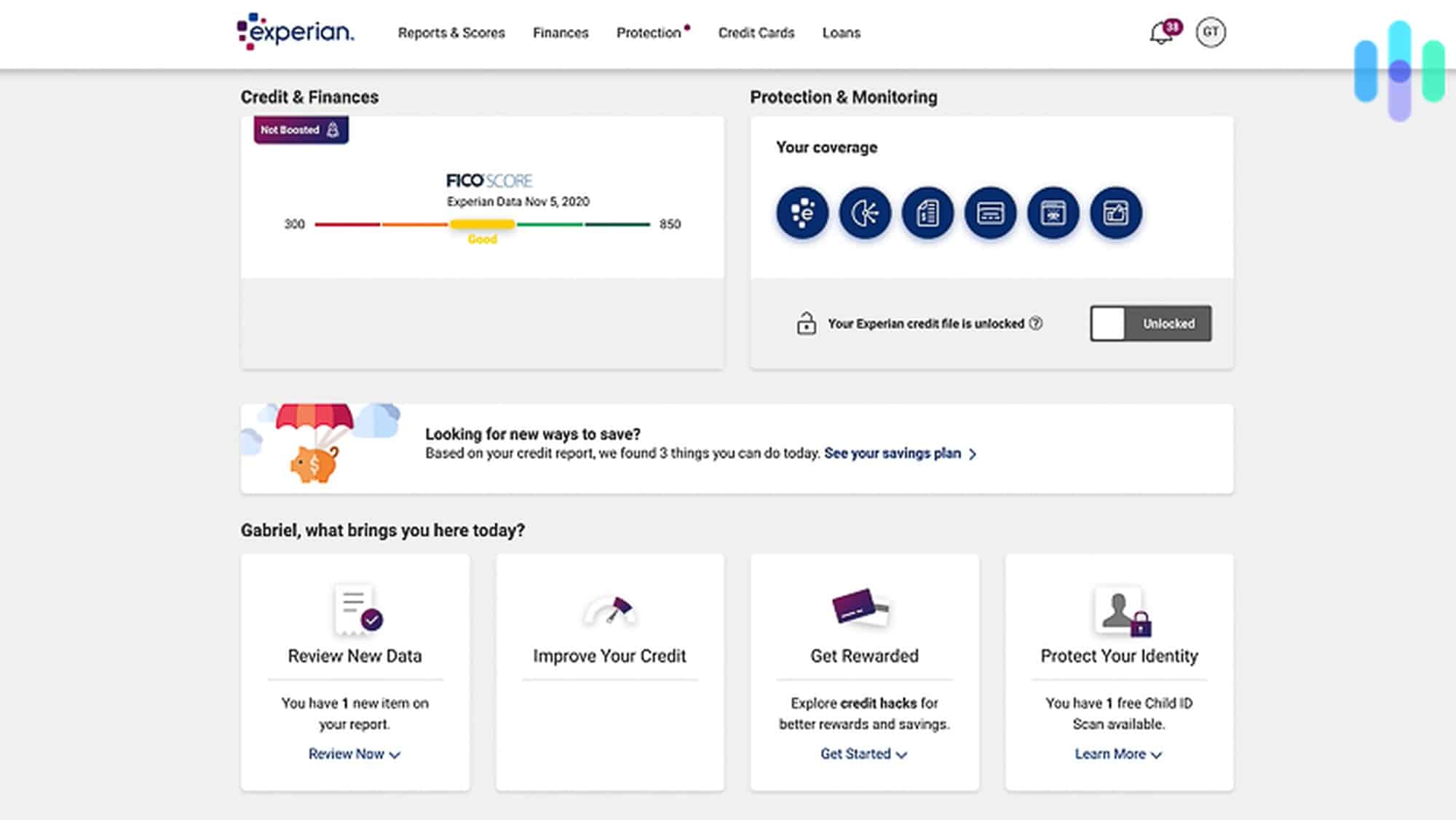

One of the three major credit-monitoring bureaus, Experian also offers identity monitoring.

- US-based fraud resolution specialists

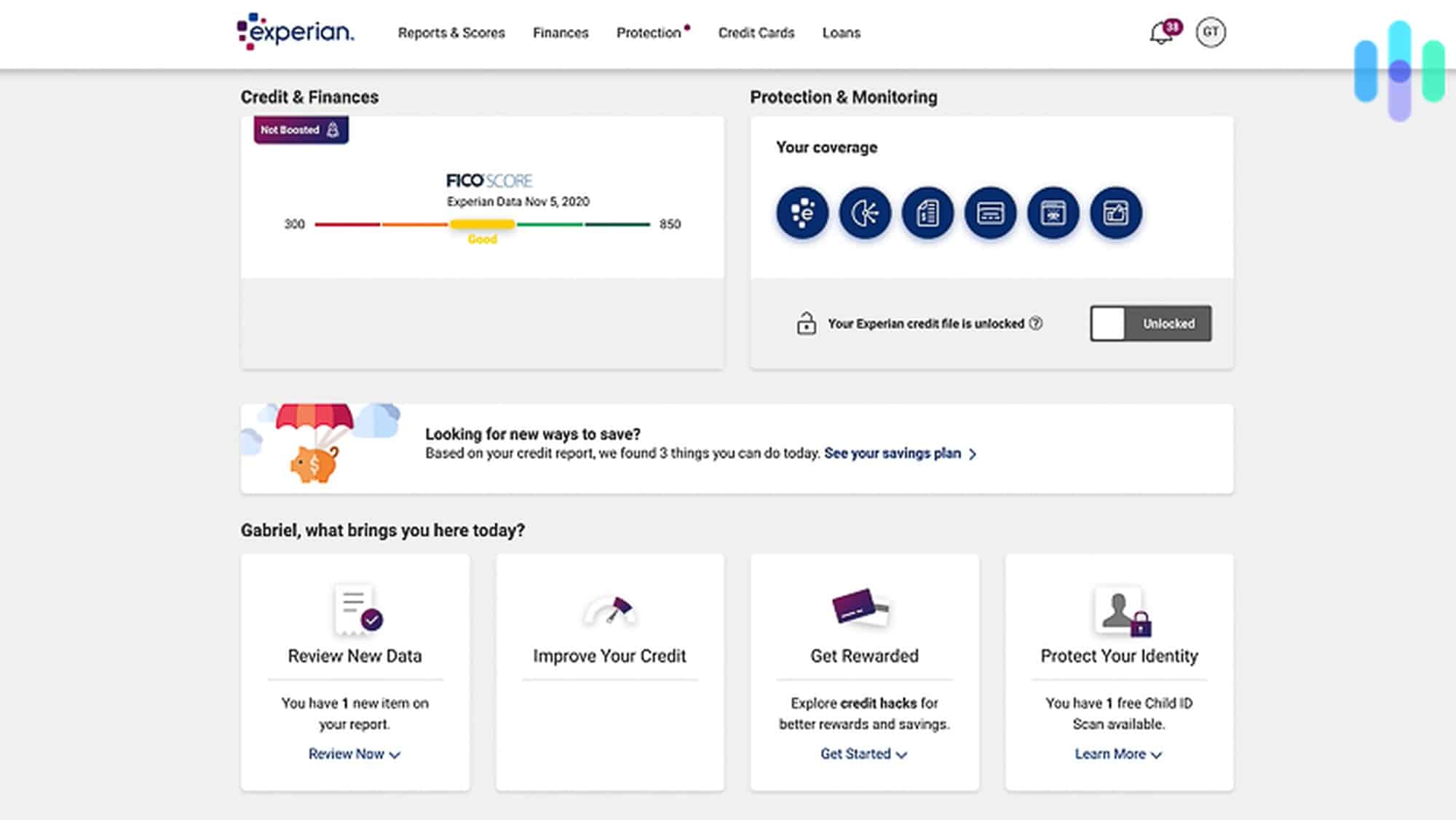

- One-tap credit file locking/unlocking

- Comprehensive fraud protections

We’ve all heard the name Experian. After all, it’s one of the three main credit-monitoring bureaus. Just because it’s a big company doesn’t mean it offers the best identity theft protection service, though. In fact, IdentityWorks isn’t even the only identity theft protection service that Experian owns. But, how can you tell if IdentityWorks is right for you and your budget? Well, we’ve tested all of Experian’s identity theft protection services ourselves. Check out our review of IDNotify to see what we thought of Experian’s other identity theft protection service.

With that said, we’re not here to review IdentityWorks today. Instead, we’re doing a deep dive on their pricing structure. Let’s face it, even if you’ve read a guide to identity theft protection services, figuring out what you’re actually getting for your money can get confusing quickly. So, let’s go through all of IdentityWorks different subscription plans, how much they cost, and what they get you.

App ratings

| Experian app version | Rating |

|---|---|

| Android | 4.7 |

| iOS | 4.8 |

Experian IdentityWorks Subscription Offerings

Experian has moved away from their previous confusing tiers to a simpler approach. Now, you can choose from three tiers of protection: a free plan, an individual plan, and a family plan. Here’s how much each plan costs:

| Plan Name</tdth | Basic | Premium | Family |

|---|---|---|---|

| Coverage | One adult | One adult | Two adults and ten children |

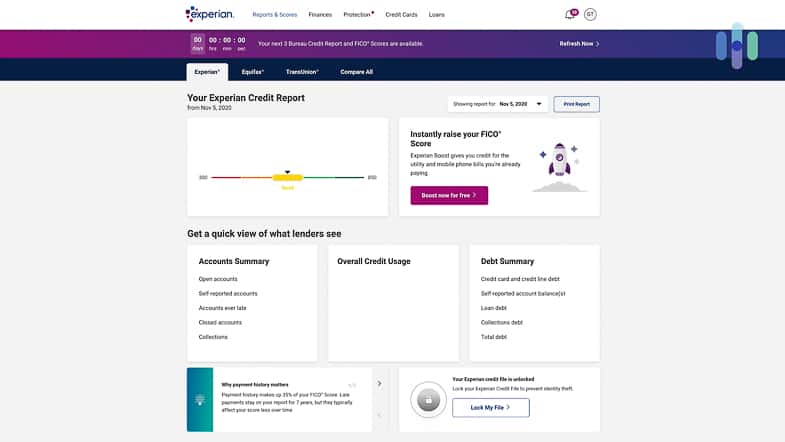

| Credit Bureaus Monitored | Experian | TransUnion, Equifax, Experian | TransUnion, Equifax, Experian |

| Monthly Cost | Free | $24.99 | $34.99 |

We recommend annual billing if you want to save some cash. When you pay yearly, a Premium account works out to be $249 instead of the $299 you’d pay monthly. That’s essentially two months free. The same savings apply to the Family plan.

Hot Tip: One million children had their identities stolen in 2017, over half of which were under seven years old,1 so don’t count out kids when it comes to identity theft.

Like with most plans, you’ll need to splurge for the Premium subscription if you want credit monitoring from all three credit bureaus. We think that the coverage from three credit-reporting bureaus makes the plan worthwhile, but let’s look at a breakdown of what else we actually got with this coverage.

How Experian Stacks Up to the Competition

We found that Experian offers reliable identity protection, but we noticed some quirks with their data handling practices. The mobile app could also use some polish. Before you sign up, it's worth exploring what other providers bring to the table. Check out the three top options below to see if they might be a better fit:

What Does Experian IdentityWorks Cover?

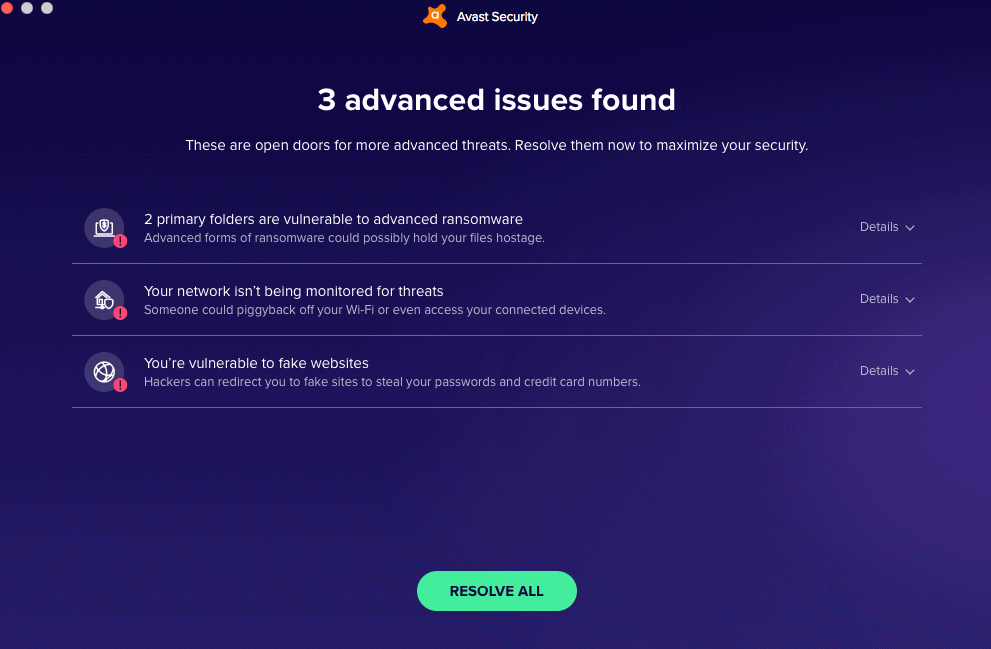

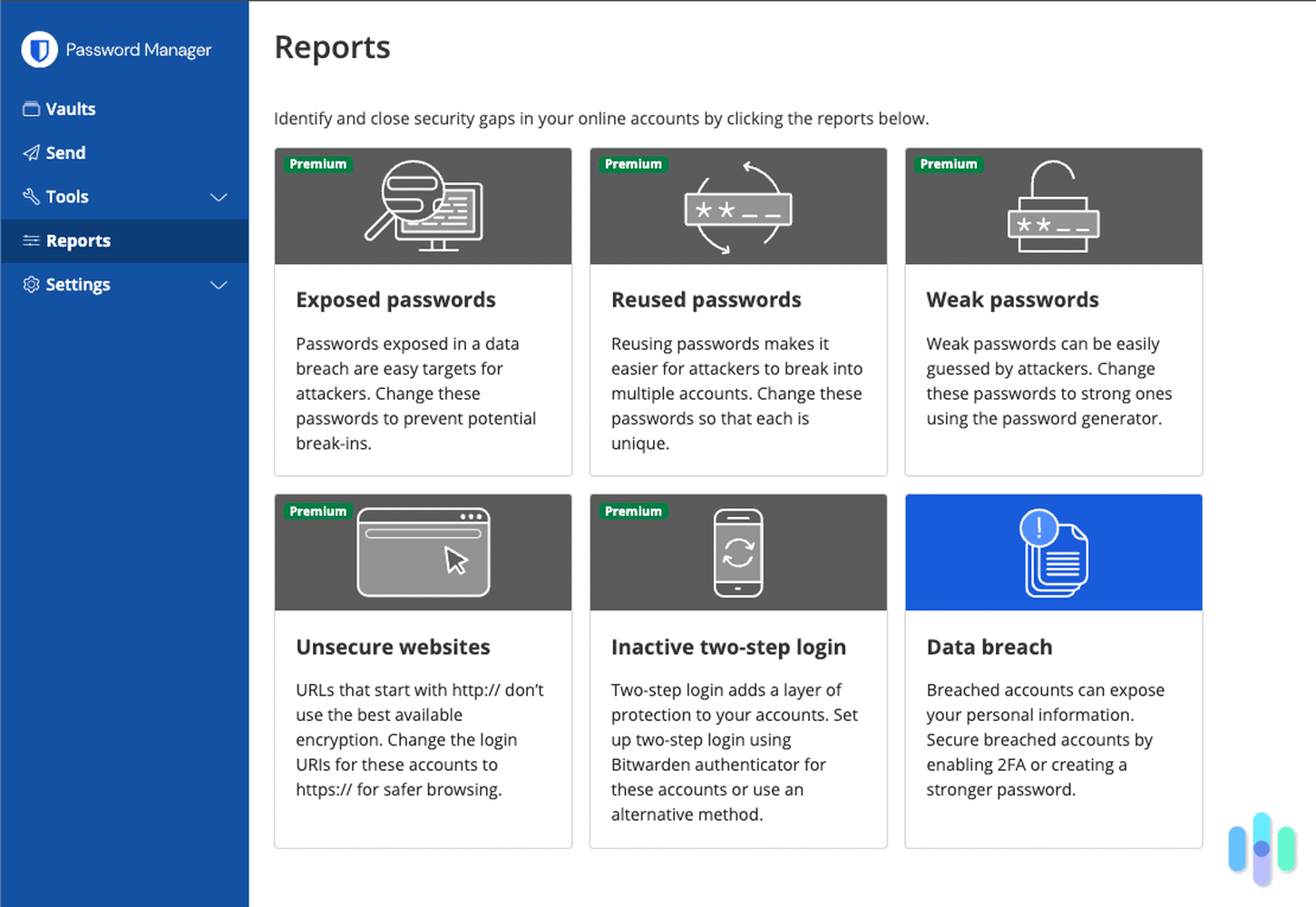

The free Basic plan only offers Experian credit monitoring. The paid tiers include the protective features you expect from identity theft protection services, including:

- Identity theft insurance: This coverage reimburses you for expenses like legal fees, lost wages, and costs to restore your credit. Both Premium and Family plans include up to $1 million in coverage, which is the industry standard.

- U.S-Based Fraud Resolution Specialist: The fraud specialist is there to help with every stage of the worst-case scenario when an identity has been stolen.

- Lost Wallet Assistance: If we ever end up losing our wallets, the restoration specialists would help us cancel the cards and replace them. We could do this ourselves, but it sounds calming to have a helping hand in what we assume would be a super-stressful situation.

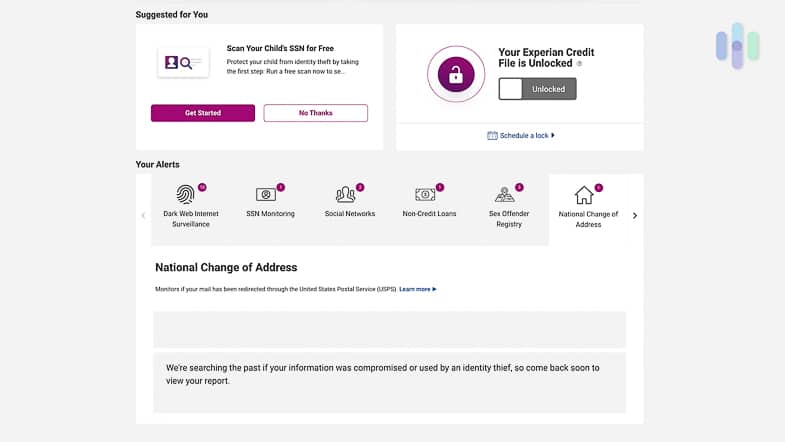

- Identity Theft Monitoring & Alerts: IdentityWorks sends instant alerts when your personal info appears in places where it shouldn’t. This helps minimize damage before things get out of control. Both protection levels track:

- Social Security Number usage

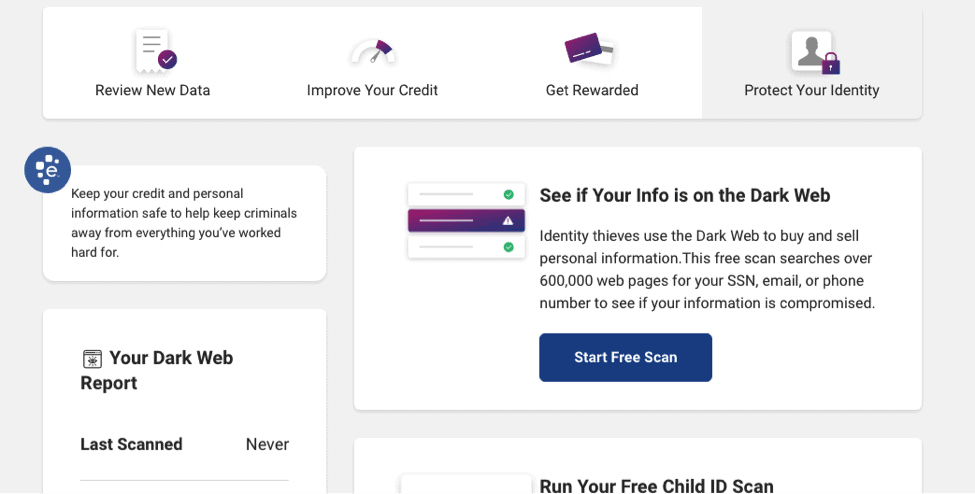

- Dark web surveillance

- Address Change Verification

- Real-time Alerts on Attempted Credit Inquiries

- Lock and Unlock Your Experian Credit File: If anything suspicious happens (are we jinxing it by mentioning the possibility too much?) one of the first things we’d do is to lock our credit reports so nobody can take action with them. And once the issue has been resolved, we’d be able to unlock them just as easily.

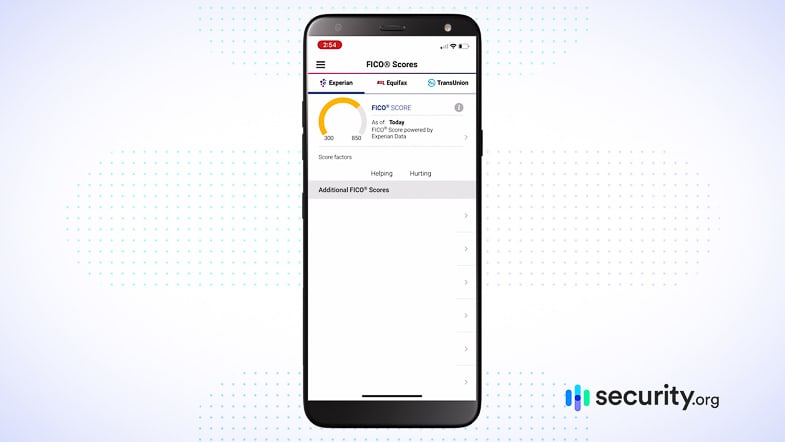

- Daily Experian FICO Score Alerts: While this level of detail might feel excessive for some, it’s perfect if you’re actively building credit for a major purchase like a home. It’s also useful if you’re repairing past credit issues. These daily touchpoints keep you motivated and informed. Experian has a few FICO offerings:

- Score Tracking

- FICO Score Simulator

- Additional FICO Scores

The More You Know: FICO is a type of credit score that lenders use frequently to figure out how likely customers are to repay a loan.2 A three-digit number, your FICO score can affect the size, length, and interest rates of the loans you receive. Over 90% of the most commonly used lenders use FICO scores when making loan decisions, so if we’re ever going to get a mortgage for a fancy Brooklyn brownstone, our FICO scores are key.

That’s a lot of coverage that makes us think our identities will be pretty safe. And for $10 more per month, you can protect your entire family too. That’s why Experian made our list of the best identity theft protection services for families.

FYI: The Identity Theft Resource Center reported 3,205 data compromises in 2023, affecting over 353 million individuals.3 Experian’s file-sharing and social network monitoring could let you know if your information has been compromised, but it also helps to mix up your passwords and avoid the easy ones (looking at you, Password123).

Does Experian Offer a Free Trial?

Experian offers a 30-day free trial to test its services. There is a catch. You’ll need to provide your Social Security Number upfront, which is unusual. Once the trial ends, you’ll automatically roll into a Premium subscription. We recommend marking your calendar if you decide to cancel.

How to Cancel Experian

Speaking of canceling, this requires some effort. We recommend calling their customer service directly at 1-866-617-1894. Based on our past experience with Experian customer support, which was a little lacking. There’s definitely no charge if you decide to cancel before your free 30-day trial has ended, but after that, you won’t be able to pro-rate your current month’s paid membership fee.

Favorite Features

If you haven’t already checked it out, we’ve done a full review of Experian’s identity monitoring services. Overall, we were pleased with it. Here’s what we were most excited about:

- Daily credit reports and scores: When we’re paying for a credit and identity monitoring service—especially for one directly from a credit bureau—the main thing we want is a lot of data. The daily credit reports and scores definitely filled that gap and are perfect for anybody looking to keep a close eye on their financial information.

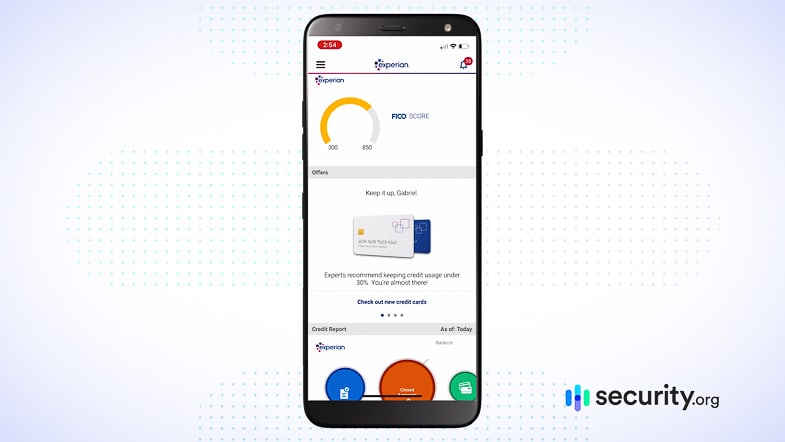

- Great apps on iOS and Android: Apps are key these days. Honestly, you could be offering us free ice cream cones every day, but if the app to get them is hard to navigate, we won’t bite very often. The Experian app is definitely more focused on credit rather than their side-gig identity protection, but it’s ideal for a quick check-in to make sure everything looks okay.

- Free 30-day trial: Nothing beats free, and with an entire month of IdentityWorks, we felt we had enough time to confidently decide if this service was the right one for us.

Recap

Ultimately, Experian IdentityWorks is not our absolute favorite identity theft protection service this year, which is not to say that we wouldn’t recommend it at all. However, the app isn’t anything to write home about, and the customer service was truly lackluster, which was really annoying for us at times. And don’t forget that they’re collecting all that identifying information that we’ve asked them to protect. It gave us the heebie-jeebies, but hey, at least they haven’t had any big breaches lately, unlike some other companies. And Experian does come at a great price point, especially for large families. With a free trial, affordable prices, and extensive monitoring, they’ll definitely help you to stay safe online as they did us.

FAQs

-

What is Experian IdentityWorks?

Experian IdentityWorks is an identity theft protection service from the Experian credit bureau. The service offers an extensive array of credit monitoring features alongside their identity monitoring and fraud resolution assistance. They offer two plans: IdentityWorks Plus and IdentityWorks Premium.

-

Is Experian IdentityWorks worth it?

Experian IdentityWorks is certainly worth it. The service has one of the lowest price-points of the industry for their identity monitoring services. The company has the advantage of being a credit bureau itself, so it’s the best bet for those wanting the extra credit features like CreditLock, more frequent credit scores and FICO scores. Its option of including up to two adults and 10 children on one plan makes it a good choice for families too.

-

How accurate is Experian?

Experian scores are accurate. Since Experian is one of the credit bureaus that calculates FICO scores, we definitely trust them when it comes to the accuracy of our credit scores and reports. However, it’s important to keep in mind that the daily alerts provided are based only on Experian’s calculations. Only with the Premium plan can users receive quarterly FICO scores that pull from all three credit bureaus, which are the most comprehensive scores available.

-

How much does Experian IdentityWorks cost?

After the first free month, an Experian IdentityWorks membership can cost between $9.95 and $29.95 per month, depending on the plan you opt into and how many people are on the plan. The costs decrease 17% if you opt to pay annually instead of monthly. If you do not cancel within the trial period, you are automatically enrolled in the Premium plan.

-

Which is better, Experian or Equifax?

We believe that Experian is better than Equifax. The actual level of service is comparable, but the subscription price is $10 per month lower with Experian, which applies to both individuals and family plans. And in case you were wondering, of the three credit bureaus, TransUnion comes in last among the three. Not only does it offer fewer services, but it also charges the highest monthly fee.

-

Javelin. (2018). 2018 Identity Fraud: Fraud Enters a New Era of Complexity.

javelinstrategy.com/coverage-area/2018-identity-fraud-fraud-enters-new-era-complexity -

MyFico. (2020). What is a FICO® Score?

myfico.com/credit-education/what-is-a-fico-score -

Identity Theft Resource Center. (2024). ITRC 2023 Annual Data Breach Report.

https://www.idtheftcenter.org/publication/2023-data-breach-report/