NFT Awareness and Adoption Report

NFT familiarity skyrocketed and ownership doubled between 2021 and 2022, and continues to grow and innovate.

The concept of non-fungible tokens (NFT) has gained traction in recent years, particularly among cryptocurrency enthusiasts. NFTs are unique digital items such as art, collectibles, or game items, that can be created and traded on blockchain networks like Ethereum.

However, the crypto market has proven to be unpredictable, and ever-changing economic conditions have impacted the NFT market. Consumer attitudes toward buying digital art have also changed. While millions of Americans have experimented with NFTs, the initial hype has cooled considerably. Many people now view NFTs as a speculative bubble that has largely deflated.

As a follow-up to our inaugural NFT report, Security.org conducted a study of more than 1,000 American consumers to find out what they know about NFTs, and how they feel about trading these digital assets in the current economic climate. Here’s what our experts discovered about NFT awareness and adoption through this survey.

Summary of Key Findings:

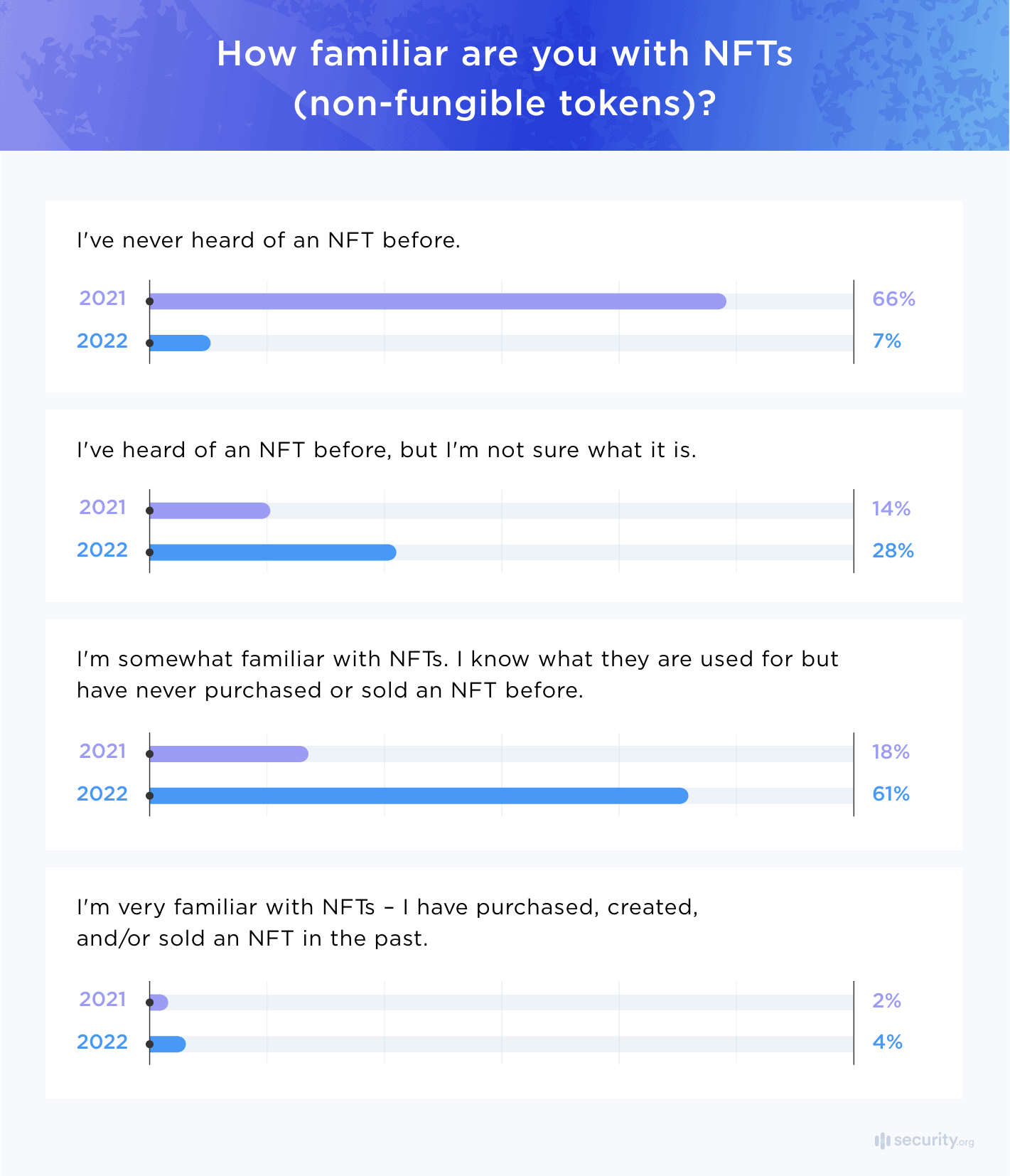

- Familiarity with NFTs skyrocketed between 2021 and 2022. Before that, two in three Americans had never heard of NFTs, but now, only 7 percent are unaware of NFTS.

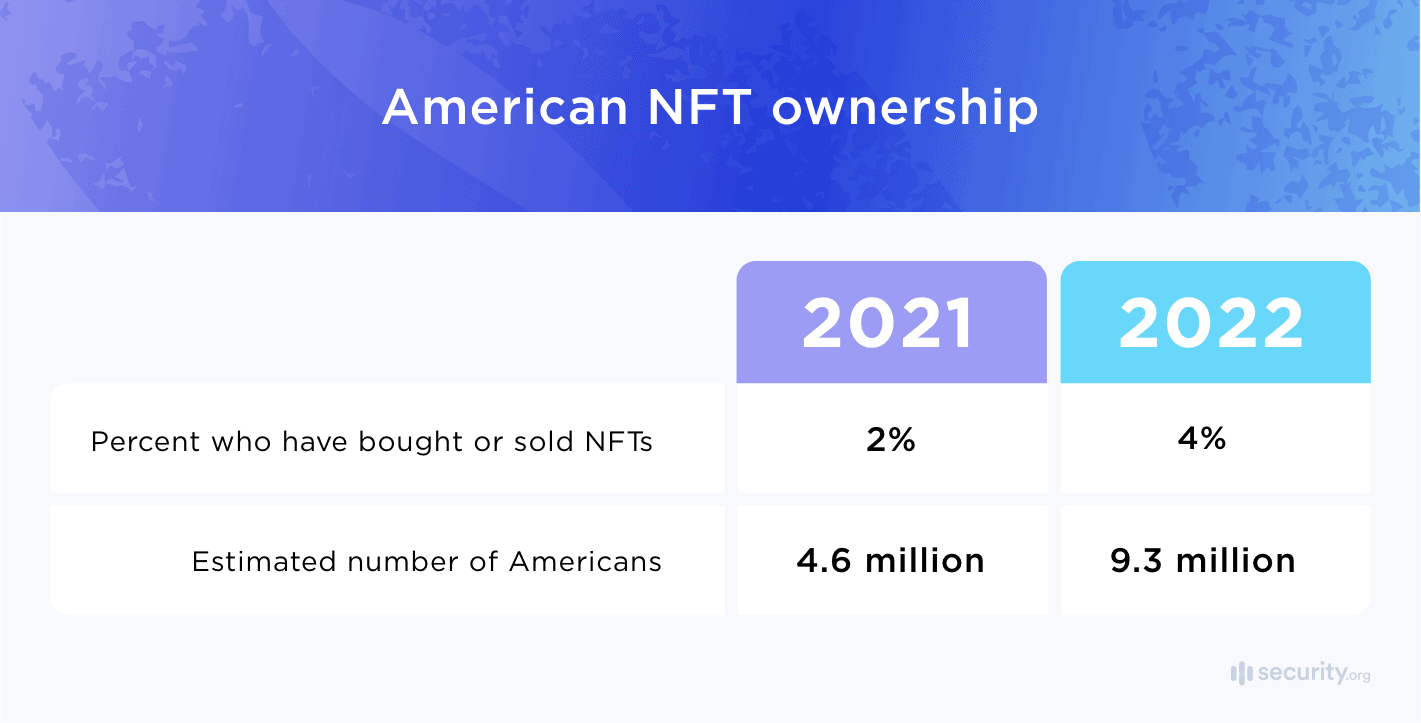

- Participation has doubled over the same time period, though only about 4 percent of U.S. adults have ever owned NFTs until this point.

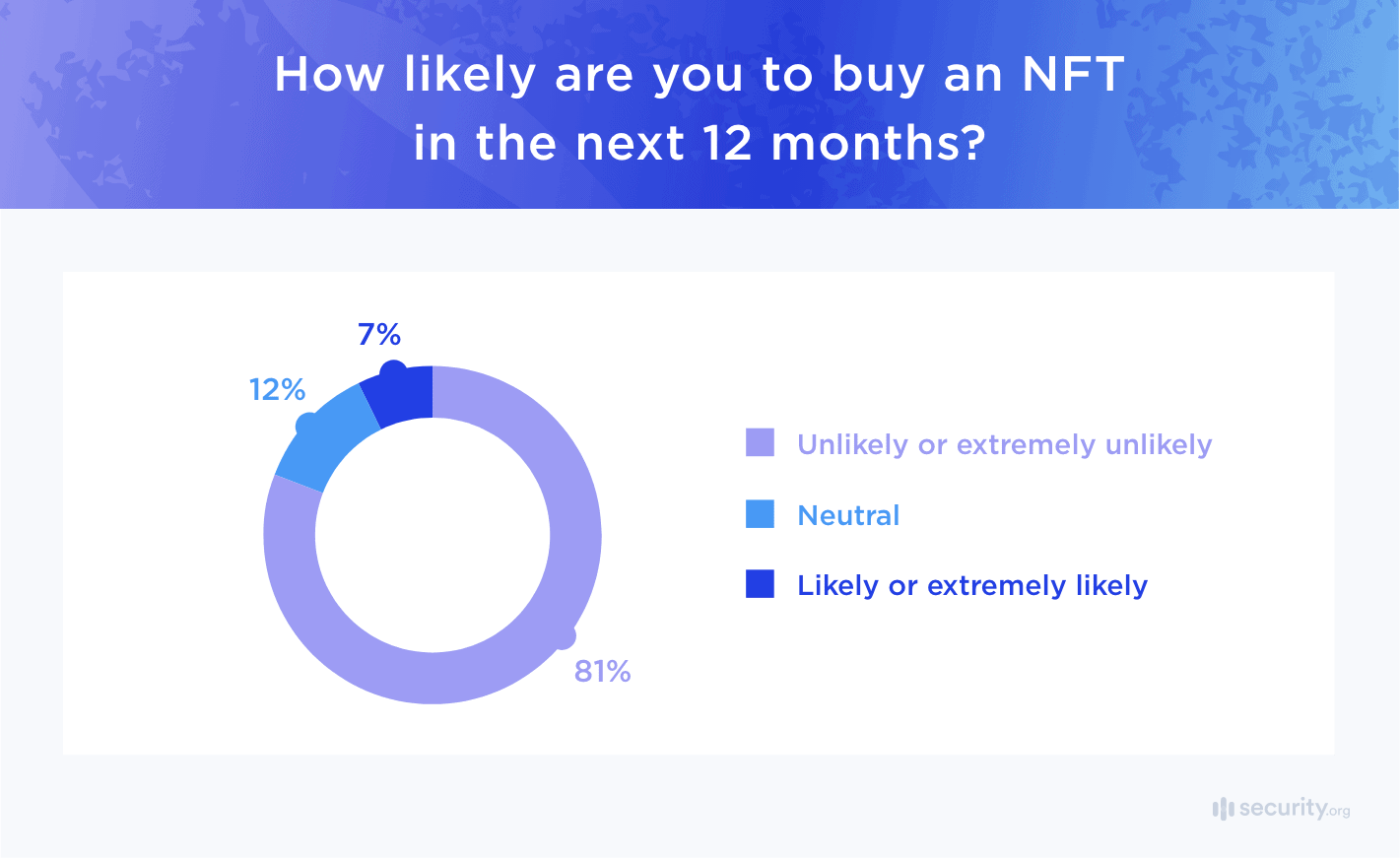

- While the vast majority of Americans are not ready to purchase NFTs, about 7 percent of non-owners said they’d be likely to purchase in the next 12 months. This equates to as many as 16.3 million potential customers.

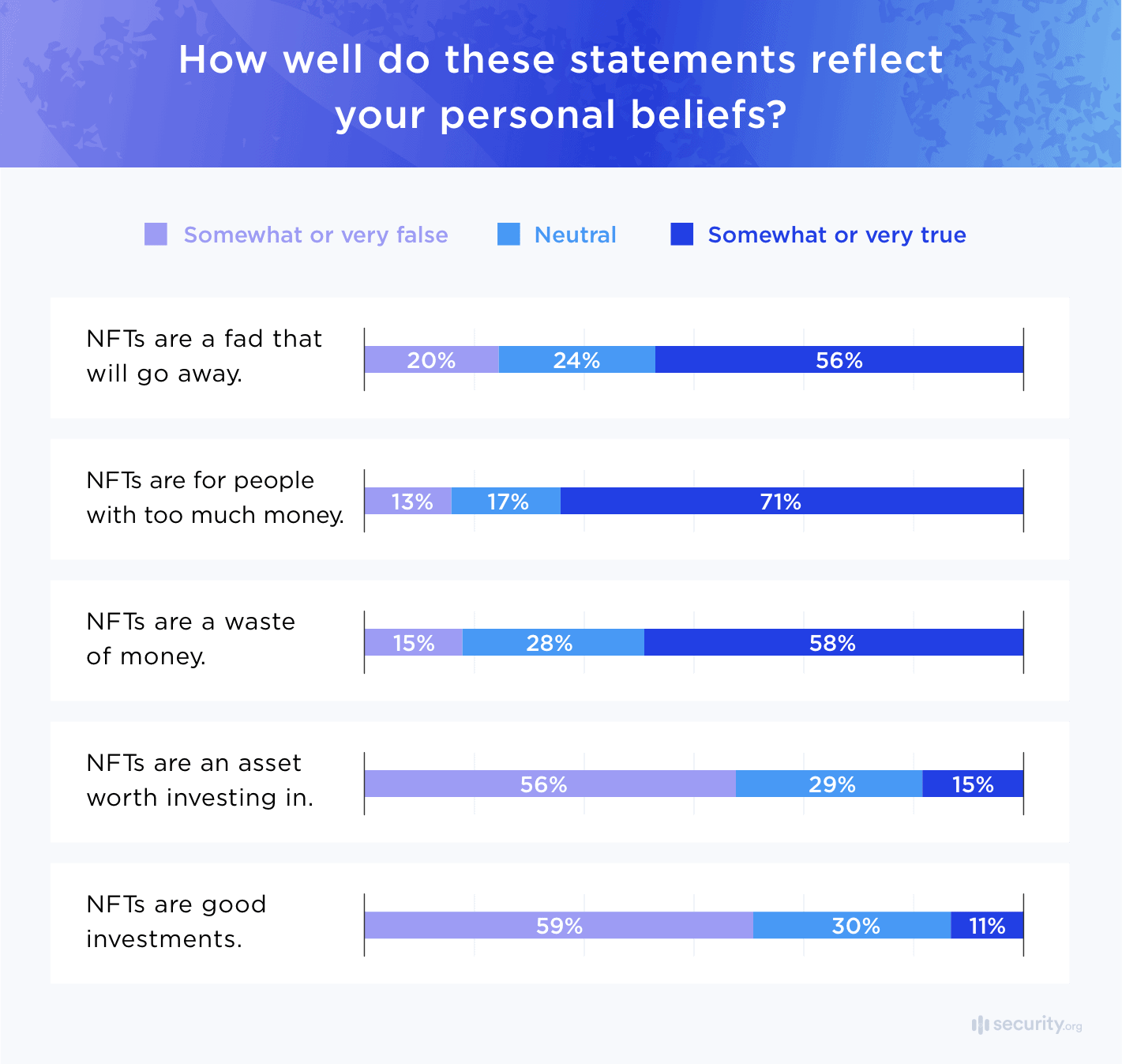

- Only around 15 percent of people believe that NFTs are worth investing in currently.

Awareness of NFTs Has Exploded Since 2021

The number of people who have gained familiarity with non-fungible tokens has soared since our original study in 2021. In fact, the percentage of people who are at least somewhat familiar with NFTs has risen from 20 percent to 65 percent in that time. By a smaller margin, NFT participation has also increased since last year, rising from 2 to 4 percent.

When those who claimed to be at least somewhat familiar were asked to put their knowledge to the test an astonishing 81 percent were able to define them correctly as “digital assets that represent real-world objects,” compared to just 29 percent in 2021. Compared to older and younger age groups, 25 to 34-year-olds were most likely to be at least somewhat familiar with NFTs.

As awareness has risen in recent years, so have sales. In 2021, NFT sales generated $25 billion, compared to just $94.9 million in 2019. The explosion of interest in NFTs is a testament to the unpredictability of adoption curves. Let’s explore a few reasons why NFTs have grown so much over the past year.

Factors Driving Increased NFT Awareness

Rise in Crypto Popularity

Cryptocurrency ownership to NFT investment is interconnected. In 2024, approximately 17 percent of Americans owned cryptocurrency, creating a substantial base of potential NFT buyers who already understand blockchain technology.1 As cryptocurrencies have risen in popularity, so have NFTs, which are built on the blockchain. For people who already own cryptocurrency, especially Ethereum, it’s relatively easy to test out investments in alternative crypto ventures like non-fungible tokens.

Growing Number of NFT Creators and Artists

For artists, NFTs have several unique benefits compared to more traditional art forms. Since they’re built on the blockchain, traders can authenticate and trace the ownership of their digital assets, and artists can directly monetize and authenticate their pieces without galleries or museums. Many graphic artists have started creating NFTs because of the potential earnings: in December 2021, NFT artist Pak broke a record as “The Merge” collection sold for nearly $92 million.3

Celebrity Buzz

NFTs have also attracted a lot of attention from celebrities and other notable figures. Their conversations and social media posts have helped promote the concept of NFTs more than any other source. The Bored Ape Yacht Club NFT counts Paris Hilton, Stephen Curry, and Jimmy Fallon among its high-profile owners. Furthermore, there are only 10,000 Bored Apes available for purchase,4 so many people compete to get them. These two factors make them valuable as a collectible and status symbol.

Editor’s Note: In 2023, a class-action lawsuit was filed against the parent company of the Bored Ape Yacht Club, some of its executives, and celebrity promoters. The lawsuit alleged the company sold and promoted unregistered securities through fraudulent celebrity endorsements. The case was largely dismissed in late 2023, though some claims proceeded.

NFT Ownership Has Doubled Over Past Year

By 2022, four percent of Americans (approximately 9.3 million people) said they had ever owned NFTs. While this figure may seem low, it represents a 100 percent increase from 2021. Growth has plateaued since then, with ownership rates remaining relatively stable through 2024.

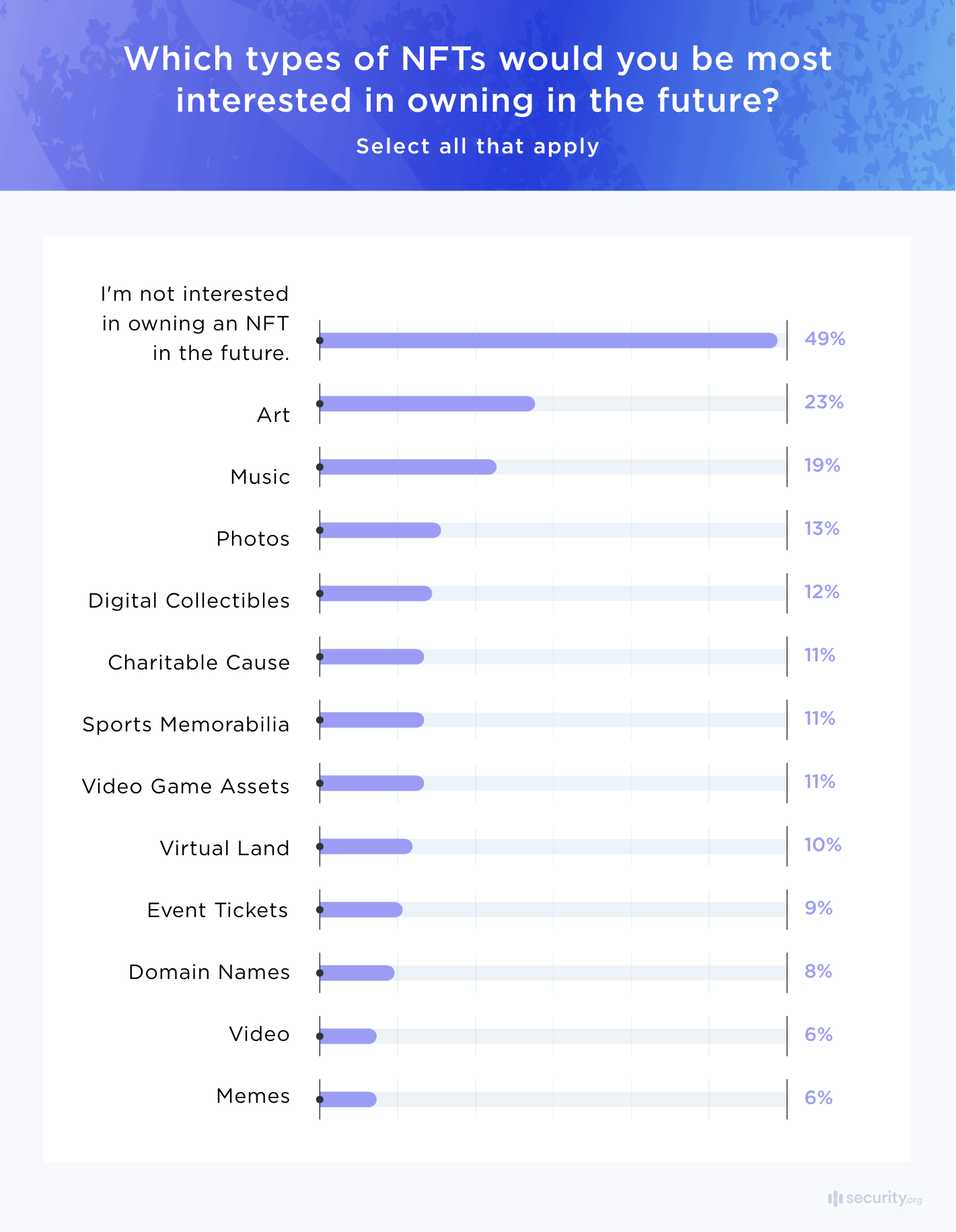

While art-related NFTs were most popular among the owners in our study, there are a wide variety of NFTs to choose from. They can represent anything, whether it is a piece of music, a piece of virtual fashion, or clips of memorable sports moments. This is one of the reasons why they are such a unique form of blockchain technology.

NFTs can also take on a variety of uses. Owners can collect them, exchange them, store them, trade them, play with them, and use them as a digital identity, as a form of payment, or even as an investment vehicle. The blockchain is really great at storing and securing information and data. With the blockchain, people can easily make transactions between digital entities.

Factors preventing greater market growth

The cost of creating and trading NFTs remains a significant barrier to entry. While Ethereum gas fees have decreased from their 2022 peaks, minting an NFT on Ethereum still typically costs between $50 and $150 in gas fees during normal network congestion. Fees can still spike much higher during peak times. Additionally, the Ethereum blockchain requires a large amount of computing power compared to many other coins, which could be unsustainable in the long run.

To address these issues, many NFT projects have migrated to alternative blockchains. Platforms like Solana, Polygon, and Arbitrum now host many NFT ecosystems. Transaction fees are under $1, and they offer faster processing times. Reports reveal that these alternatives have processed more than 60 percent of NFT transactions by volume in 2024.

The cryptocurrency market’s volatility during 2022 and 2023, including the collapse of FTX and multiple bank failures, has made people more hesitant to invest in digital assets. This caution extends to NFTs, which are often purchased using risky cryptocurrencies.

About half of non-owner respondents said they weren’t interested in owning NFTs, but many others were open to the idea of purchasing them in the future. Art and music NFTs were most popular among those who were interested in future investments.

How People Perceive NFTs

Though awareness and ownership has skyrocketed in recent years, our research revealed that many people believe that NFTs are a fading fad. This perception has been reinforced by the market’s dramatic decline from its peak. Many high-profile NFT collections lost 90 percent or more of their value. Despite this, about one in three people strongly believed that NFTs were a waste of money, but they can be purchased in safe, responsible ways.

Those who are curious about making an NFT purchase should approach it as they would any other type of investment. They should choose an NFT that they’d like to own regardless of change in value and pay an amount that they’re willing to lose.

It is crucial for potential buyers to establish the appropriate level of risk they are willing to take when investing in NFTs and consider how much exposure they have to the crypto market before deciding how to approach it. They should also closely monitor cryptocurrency values, and factor them into their decisions to buy NFTs. Financial experts now recommend treating NFTs as highly speculative investments that should comprise no more than 5 percent of a diversified portfolio, if included at all.

NFT Market Growth Projections

While the speculative NFT bubble may have burst, the technology continues to evolve and find new applications beyond digital art. Today’s NFTs are being used for practical purposes like event ticketing, membership passes, and digital identity verification. As earlier NFT adopters show success with their digital purchases, late adopters may feel more comfortable jumping in. NFTs are also entering gaming ecosystems. Companies like Epic Games and Ubisoft are reportedly exploring blockchain integration for in-game assets and rewards.

Though four out of five non-owners said they were unlikely to purchase NFTs over the next year, seven percent of non-owners were likely to get into the market at the time of our survey.

Those ages 25 to 34 were slightly more likely to purchase in the next 12 months than those in older or younger age groups. Our research also found that men were slightly more interested than women in making a purchase in the next year. This aligns with broader research showing that men are nearly twice as likely as women to own cryptocurrency and engage in higher-risk digital asset investments.

We also found that people who are invested in cryptocurrencies are more likely to own NFTs or plan to own NFTs than those who do not own or do not want to own them. Once someone holds cryptos, it would be easier to purchase NFTs because they already have the currency required to accomplish a transaction and are more familiar with the blockchain.

There are several key reasons why people avoid purchasing non-fungible tokens today. The market’s dramatic crash has validated many skeptics’ concerns about NFTs being overvalued. Additionally, high-profile scams and rug pulls have eroded trust in the space. The complexity of safely storing and managing NFTs also remains a significant barrier for mainstream adoption, as users must navigate unfamiliar concepts like wallet security and private keys.

Conclusion

Although there’s still a high percentage of people who need more education about NFTs, ownership and participation have grown significantly from 2021 to 2022. However, the subsequent market crash and ongoing crypto volatility have dampened enthusiasm and slowed adoption rates.

The future of NFTs is uncertain. Industry experts predict that successful NFT projects will focus on providing real utility rather than relying on hype. Areas like gaming, ticketing, digital identity, and creator monetization show promise. However, the days of million-dollar profile pictures may be largely behind us. That won’t stop the underlying technology from evolving and finding its place in the broader digital economy as infrastructure matures and use cases become clearer.

Our Data

Security.org conducted an internet-based survey of 600 U.S. adults ages 18+. Participants were 50% women and 50% men and were representative of the U.S. population in terms of their ages. Four percent of participants had ever bought, sold, or created NFTs at the time of our survey.

FAQs About NFTs

-

What is NFT?

NFT stands for non-fungible token. Fungibility refers to whether or not it can be traded with one another. For instance, Bitcoin is fungible because each Bitcoin has the same value so they can be traded with one another. NFTs do not have the same value so they cannot be traded with one another and are therefore non-fungible.

-

Are all NFTs scams?

Although there are a lot of scams in the NFT world, there are plenty of legitimate use cases for NFTs as well. Always look out for deals that seem too good to be true when dealing with NFTs. That should be your warning sign to steer clear.

-

Will I lose my money if I buy a NFT?

Just like buying real art, there’s plenty of art out there that doesn’t retain its value. Over time, most pieces of art fade away and lose their value. But, there are still NFTs that can grow in value.

-

Can I make money off of NFTs?

More often than not, you won’t make money off of NFTs. You can make your own NFTs though which can be a great way to sell your own online art.

-

Are NFTs still popular?

NFTs experienced a massive boom during 2021 and 2022. They have since seen a dramatic decline in both trading volume and public interest. While the speculative frenzy has ended, NFT technology continues to develop for practical applications in gaming, ticketing, and digital ownership. The core blockchain community remains engaged, but mainstream adoption has stalled.

Citations

- Pew Research Center. (2024). Majority of Americans aren’t confident in the safety and reliability of cryptocurrency.

https://www.pewresearch.org/short-reads/2024/10/24/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

- YCharts. (2025). Ethereum Average Gas Price.

https://ycharts.com/indicators/ethereum_average_gas_price